Nodal Highlights

NODAL POWER HIGHLIGHTS

- In August, Nodal launched new 2×16 and 7×8 day-ahead power and day-ahead congestion contracts for 26 key hub and zone locations in PJM.

NODAL GAS HIGHLIGHTS

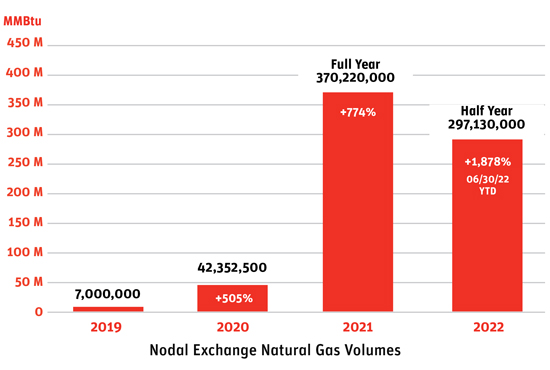

- Nodal natural gas markets continue to grow year over year.

NODAL ENVIRONMENTAL HIGHLIGHTS

- Environmental open interest for Nodal at the end of August 2022 was 197,870 lots, up 35% from a year earlier.

NODAL CLEAR HIGHLIGHTS

- Nodal Clear has grown to 18 clearing members! To view the full list, visit: Clearing Members.

Nodal launched new special class contracts in August

In response to the PJM plans to transition from traditional off-peak to the weekend peak (2×16) and weekday off-peak (7×8) for the FTR auctions, Nodal Exchange has launched the 2×16 and 7×8 day-ahead power (DAP) and day-ahead congestion (DAC) contracts for 26 key hub and zonal locations in PJM, available for trading since August 25th, 2022. The locations include key hubs, such as Western Hub, AEP-Dayton Hub, and Northern Illinois Hub, and key zones, such as BGE, PSEG, PPL, etc. This will enable the market participants to hedge the power risk exposures and the FTR portfolio risks more precisely. The DAP contracts have 69 tradeable months and DAC contracts have 49 tradeable months. The traditional off-peak contracts remain available for trading on the exchange. For more information, please contact Energy Markets or call 703-962-9820.

Nodal natural gas market is still growing

Nodal Exchange currently offers over 1,000 contracts on hundreds of unique power locations, the largest set of environmental futures and options contracts in the world, as well as Henry Hub natural gas contracts providing the most effective risk management available and cross-margining benefits to market participants. Nodal has seen growth in the U.S. natural gas market throughout the past four years.

Nodal offers access to electronic markets in natural gas, power, and environmental futures. Nodal offers Henry Hub 10k monthly contract for outrights, spreads, and strips which can be accessed via our front-end screen. In addition, we also offer the Henry Hub 2.5k per day contract for outrights, spreads, and strips. If you would like more information or access to this screen, please contact Energy Markets or call (703) 962-9820.

Nodal environmental open interest up 35% over 2021

Open interest for Nodal environmental contracts at the end of August 2022 was 197,870 lots, up 35% from 146,184 a year earlier.

Key product highlights included:

- PJM-related REC products at the end of August totaled 102,601 lots of open interest, up 24% from 82,588 a year earlier.

- Record open interest in Texas CRS wind and solar REC futures reached 37,987 lots at the end of August, up 47% from 25,793 a year earlier.

- Texas CRS wind and solar RECs in August topped the 100,000-lot milestone (102,596) in total lots traded since the respective contracts were listed on Nodal. The volume traded is the equivalent of more than 100 million MWh of renewable power.

- August posted the second highest volume month for New Jersey Solar REC futures, with 4,000 lots traded, representing 40,000 MWh of renewable power. The record month for the contract was 5,150 lots in September 2020. Also, 4,000 lots of the contract were delivered in August.

Upcoming Events

Nodal in the news

About Nodal

Nodal Exchange is a derivatives exchange providing price, credit and liquidity risk management solutions to participants in the North American commodities markets. Nodal Exchange is a leader in innovation, having introduced the world's largest set of electric power locational (nodal) futures contracts. As part of EEX Group, a group of companies serving international commodity markets, Nodal Exchange currently offers over 1,000 contracts on hundreds of unique locations, providing the most effective basis risk management available to market participants. In addition, Nodal Exchange offers natural gas and environmental contracts. All Nodal Exchange contracts are cleared by Nodal Clear which is a CFTC registered derivatives clearing organization. Nodal Exchange is a designated contract market regulated by the CFTC.