Nodal Newsletter | March 2021

Nodal Highlights

NODAL EXCHANGE ACHIEVES RECORD MARKET SHARE IN POWER AND ENVIRONMENTAL FUTURES IN FEBRUARY

Nodal achieved record share of monthly power and environmental futures trading volume in the United States in February 2021, with 46.6% and 11.7% respectively.

Nodal power accomplishments in February included:

- 218.4 million MWh traded in February, second best month ever

- 56.2 million MWh traded on February 9th, setting a daily record

- 179.1 million MWh of PJM traded volume with a record 52.5% market share of monthly futures trading volume

- 18.2 million MWh of New York ISO traded volume with a record 63.7% market share of monthly futures trading volume

Nodal environmental accomplishments in February included:

- Nodal topped 250,000 total contracts traded since the launch of environmental markets in November 2018.

- PJM Tri-qualified REC futures surpassed 20,000 contracts of open interest and 50,000 total contracts traded since launch.

- Maryland Solar RECs exceeded 10,000 contracts of open interest.

- New Jersey Solar REC futures eclipsed more than 16,000 lots of open interest.

- New York Tier I REC futures and Texas Compliance Solar Renewable Energy Certificates from CRS Listed Facilities, both only listed on Nodal, traded for the first time.

EXTREME WEATHER CONDITIONS’ IMPACT ON ERCOT POWER MARKETS

Nodal Exchange sends our condolences to all those in Texas (and other affected areas) who were adversely affected by the extreme weather conditions in February. Nodal’s risk model performed very well during this volatile period, with most live accounts holding sufficient initial margin to cover the variation margin observed. Nodal Clear worked closely with clearing members and traders to ensure any outsized margin calls were communicated and met.

NODAL ELECTRONIC TRADING

Nodal Exchange offers electronic trading in power, natural gas, and environmental products. The Nodal T7 Trading Platform can be accessed via industry leading web-based trading applications: CQG, Trading Technologies and Trayport. Please contact Nodal’s Account Management team with any questions.

Nodal Exchange achieves record market share in power and environmental futures in February

Nodal Exchange announced today that it achieved record share of monthly power and environmental futures trading volume in the United States in February 2021, with 46.6% and 11.7% respectively.

“We are excited to see strong growth in the Nodal Exchange power and environmental markets and very much appreciate the trust and support of our trading and clearing community which has enabled us to achieve these record results,” said Paul Cusenza, Chairman and CEO of Nodal Exchange.

In February 2021, Nodal achieved power futures trading volume of 218.4 million MWh ($6.1 billion per side) for a record 46.6% market share. This represents Nodal Exchange’s second highest volume month ever and a growth rate of 17.7% over February 2020. Trading on Nodal was especially strong this month in PJM with a record 52.5% market share with 179.1 million MWh of monthly futures trading volume and in New York ISO with a record 63.7% market share with 18.2 million MWh of monthly futures trading volume.

Extreme weather conditions' impact on ERCOT power markets

Nodal Exchange sends our condolences to all those in Texas (and other affected areas) who were adversely affected by the extreme weather conditions in February.

Due to the historic winter storm in Texas, from February 14th to February 19th ERCOT experienced a severe loss of power generation and skyrocketing demand. According to ERCOT, at the most severe point during the outage approximately 48.6% of generation was offline due to the extreme weather conditions. As a result of the imbalance, wholesale electricity prices in ERCOT hit the system-wide offer cap of $9,000 per megawatt hour (MWh) for an extended period of time. The average hourly locational marginal prices (LMPs) from the 14th to the 19th went above $6,600 per MWh for ERCOT North Hub for both day-ahead and real-time markets. In the futures market, the price of the February 2021 ERCOT North Hub real time contract jumped from $420 per MWh before the storm to $1,522 per MWh on February 16th and peaked at $2,011 per MWh on February 17th on Nodal Exchange.

Nodal’s risk model performed very well during this volatile period, with most live accounts holding sufficient initial margin to cover the variation margin observed. This was due to stress protections built into the margin model and its naturally adjusting design framework—indeed, no margin model parameter adjustments were necessary.

Nodal Clear worked closely with clearing members and traders to ensure any outsized margin calls were communicated and met. In addition, Nodal Exchange promptly incorporated the LMP price corrections issued by ERCOT on February 14th and February 19th into Nodal’s settlement prices to ensure that Nodal’s settlement prices were accurate and up to date. The monthly contracts finally settled and cleared without incidents or defaults on March 3, 2021.

Nodal offers access to electronic markets

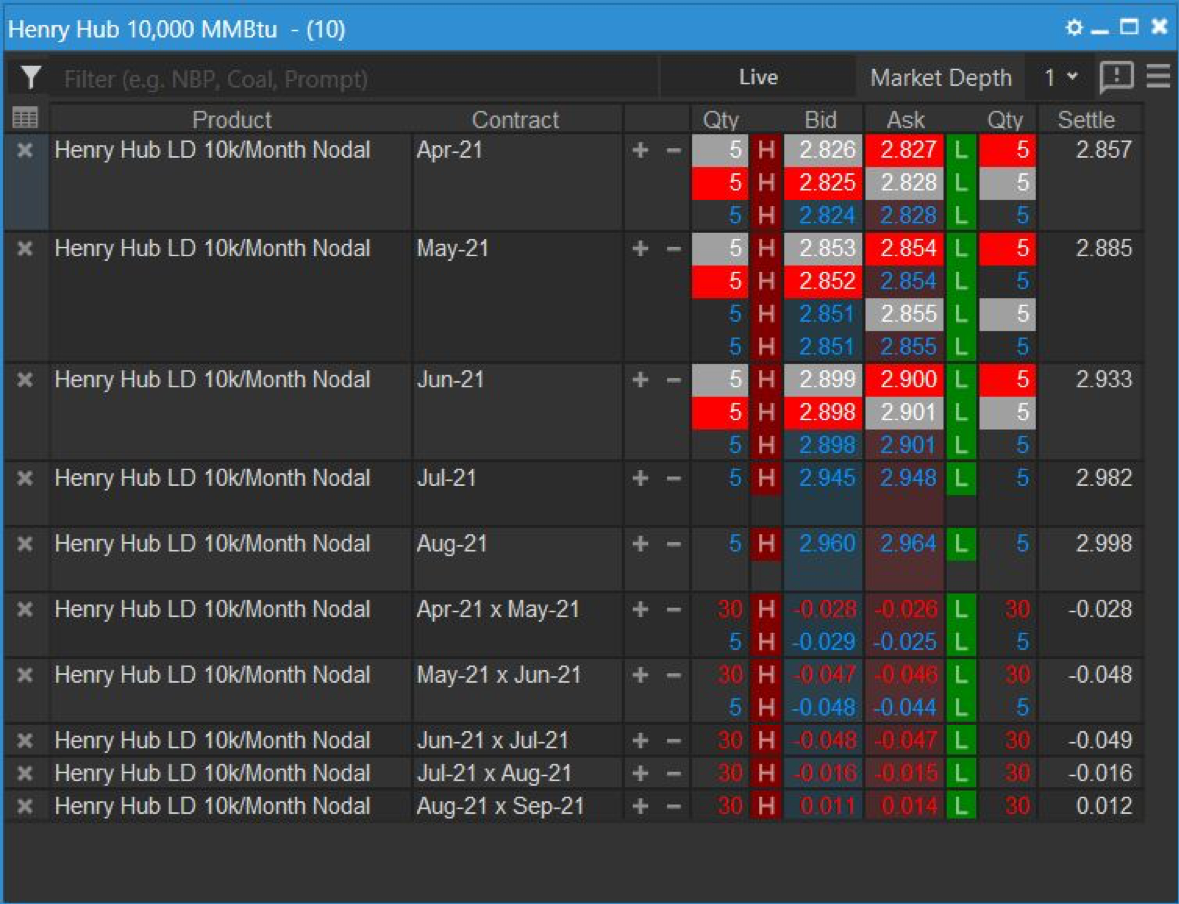

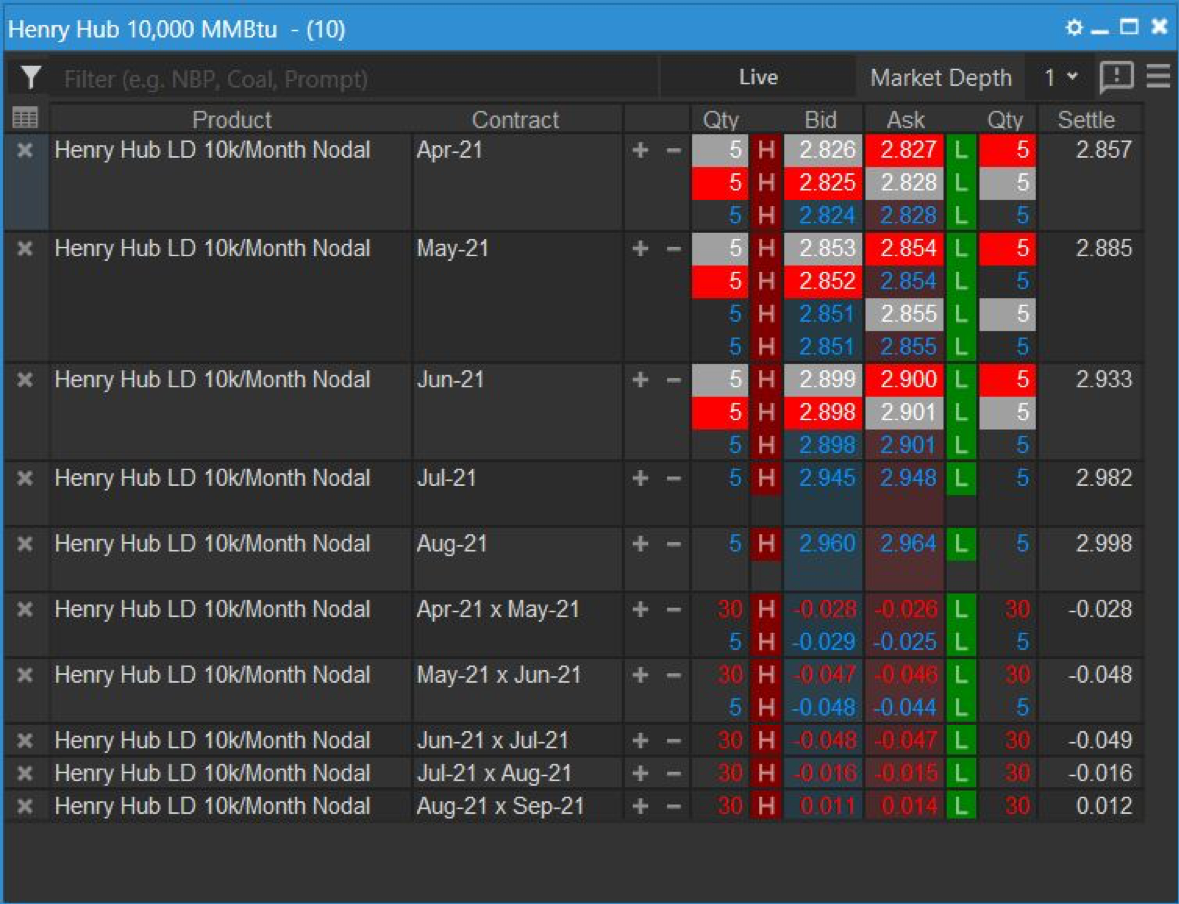

Nodal Exchange offers access to electronic markets in natural gas, power, and environmental futures. Above is a snapshot of our live markets for the Henry Hub 10k monthly contract for outrights, spreads, and strips which can be accessed via our front-end screen. In addition, we also offer the Henry Hub 2.5k per day contract for outrights, spreads, and strips. If you would like more information or access to this screen, please contact Energy Markets or call (703) 962-9820.

Nodal in the news

February 2021

Nodal Exchange sets daily trading record in power futures

Learn more

February 2021

Nodal Exchange achieved record year-end open interest

Learn more

February 2021

Environmental derivatives central to US energy transition - Nodal

Learn more

About Nodal

Nodal Exchange is a derivatives exchange providing price, credit and liquidity risk management solutions to participants in the North American commodities markets. Nodal Exchange is a leader in innovation, having introduced the world's largest set of electric power locational (nodal) futures contracts. As part of EEX Group, a group of companies serving international commodity markets, Nodal Exchange currently offers over 1,000 contracts on hundreds of unique locations, providing the most effective basis risk management available to market participants. In addition, Nodal Exchange offers natural gas and environmental contracts. All Nodal Exchange contracts are cleared by Nodal Clear which is a CFTC registered derivatives clearing organization. Nodal Exchange is a designated contract market regulated by the CFTC.